Introduction

Electricity plays a critical role in supporting the United States economy, from powering vast manufacturing operations to charging the devices used to access web pages like this one. Access to electricity comes from the grid, which encompasses all the infrastructure necessary to transport electricity from generation facilities (natural gas power plants, wind farms, etc.) to customers.

Since its beginnings under the likes of Thomas Edison and George Westinghouse in the late nineteenth century, the U.S. grid has grown to connect virtually all Americans to electricity. However, this sprawling network currently faces challenges and opportunities unique in its history. Sound regulations and policies will be key for building a grid that effectively supports the U.S. economy in the years to come.

Background

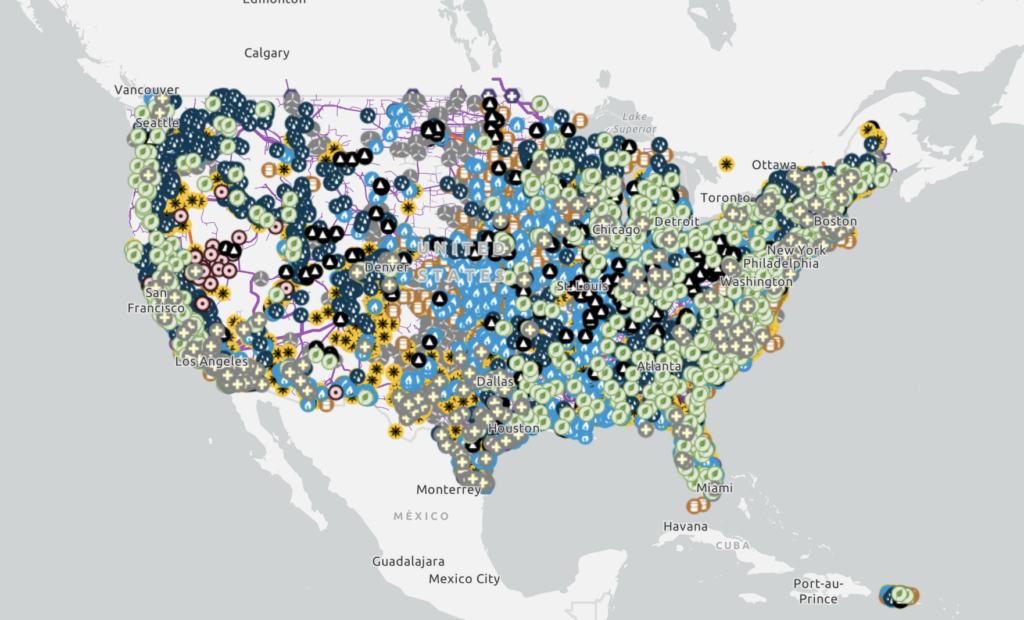

Most people are familiar with the power generation process, which involves harnessing energy from sources such as solar and nuclear power to generate electricity. Delivering this electricity to those who need it is where the grid comes in. First, transformers at electrical substations “step up” the voltage of generated electricity, allowingit to travel more efficiently. High-voltage transmission lines then transport electricity over long distances toneighborhood transformers, whichdecrease the voltage of electricity and make it safer for consumption.Finally, a network of distribution lines delivers electricity to homes and businesses. There are three major networks of transmission lines in the continental United States that operate largely separate from each other: the Western Interconnection, the Eastern Interconnection, and the Electric Reliability Council of Texas.

Click on the above map or here to interact with the data in a new tab.

The regulations and market structure of electricity provision in the U.S. have shifted considerably since the grid’s inception. Around the early 20th century, states and the federal government began strictly regulating electric utility companies. Because of the presence of substantial economies of scale, electric utilities were considered a natural monopoly, a market structure in which it is cheapest for one firm to supply the market. To preclude these firms abusing their monopoly power, governments at all levels strictly regulated the rates they could charge.

The 1990s saw yet another shift in the regulatory environment, as policymakers sought to introduce greater competition to the electricity sector. Prior to this decade, most utility companies generated, transported, and sold their own electricity in a specified region. When states began restructuring their electric power industries, many utilities sold their generation assets to independent power producers (IPPs). New entities also emerged to procure electricity and sell it to consumers, providing alternatives to electrical service provided by local utilities.

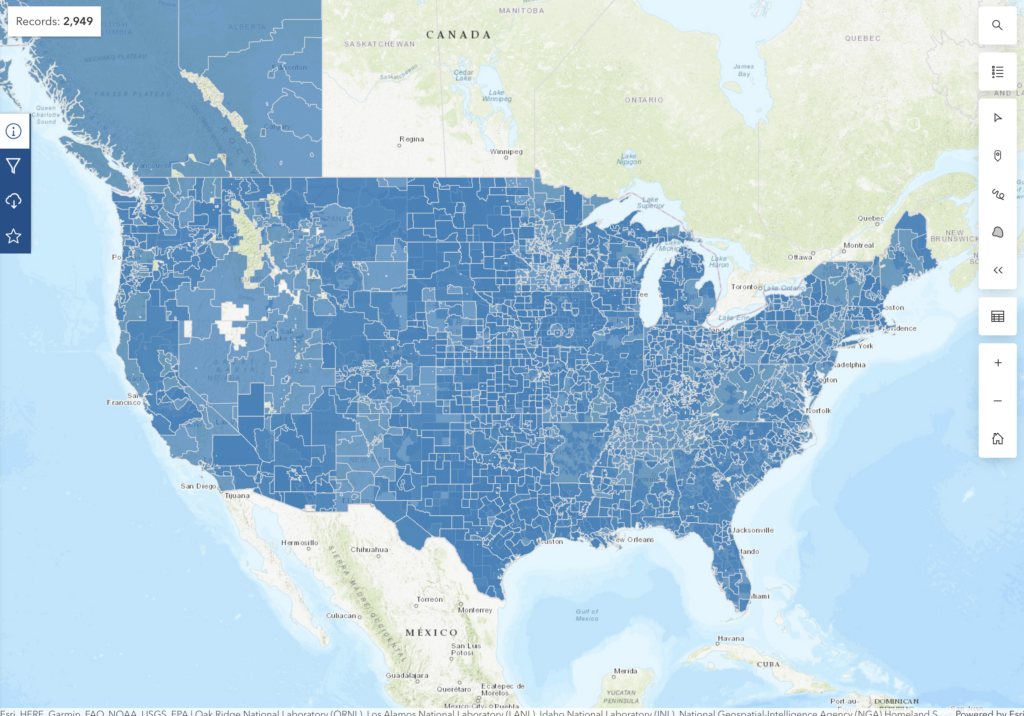

Click on the above map or here to interact with the data in a new tab.

Today, there are around 3,000 electric utility companies in the United States, and interstate transmission of electricity is regulated by the Federal Energy Regulatory Commission (FERC). While some utilities still generate electricity, their share of U.S. electricity generation has noticeably declined due to the rise of IPPs. Additionally, although utilities often build and own transmission lines, FERC Orders No. 888, 889, and 2000 led to the creation of Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs). There are seven ISOs and RTOs in the continental U.S., each of which operates transmission and wholesale electricity markets in a portion of one of the three interconnections.

Shock to the System

The U.S. grid currently faces a new and diverse set of challenges. Even as energy demands are expected to climb, the capability of the grid to deliver electricity is coming under increasing strain. Technological developments are also beginning to shift the economics of electricity production, and existing regulations are sometimes struggling to keep up.

Demand Growth

A variety of factors are converging to drive up electricity demand forecasts after a decade of fairly stable consumption. For one, consumers are increasingly switching from appliances powered by fossil fuels to those powered by electricity to reduce their carbon footprint. Electric vehicles, for example, now make up about seven percent of the U.S. light-duty vehicle fleet, and U.S. heat pump sales grew 15 percent from 2020 to 2021. As electrification continues to spread, the grid must supply more electricity to power these appliances.

Manufacturing is also playing a role in the projected surge in electricity demand. Both U.S. President Joe Biden and former U.S. President Donald Trump prioritized relocating manufacturing facilities to the United States. The Biden administration has devoted billions of dollars’ worth of subsidies and tax credits in the CHIPS and Science Act and Inflation Reduction Act toward incentivizing businesses to manufacture domestically. Companies have responded accordingly, announcing investments in new U.S. production facilities. Running these facilities, of course, requires industrial quantities of electricity.

The final major factor in the increasing demand for electricity in the U.S. is the rapid growth of data centers. There are thousands of these buildings around the world, each one containing racks of servers that house the data and web applications comprising the Internet. Data centers are energy-intensive, requiring 10 to 50 times more electricity per unit of floor space than a traditional office building throughout the day. The popularity of generative artificial intelligence applications, which are estimated to require ten times more energy per query than a Google search, will likely further enlarge data centers’ energy needs in the years to come.

Climate Change

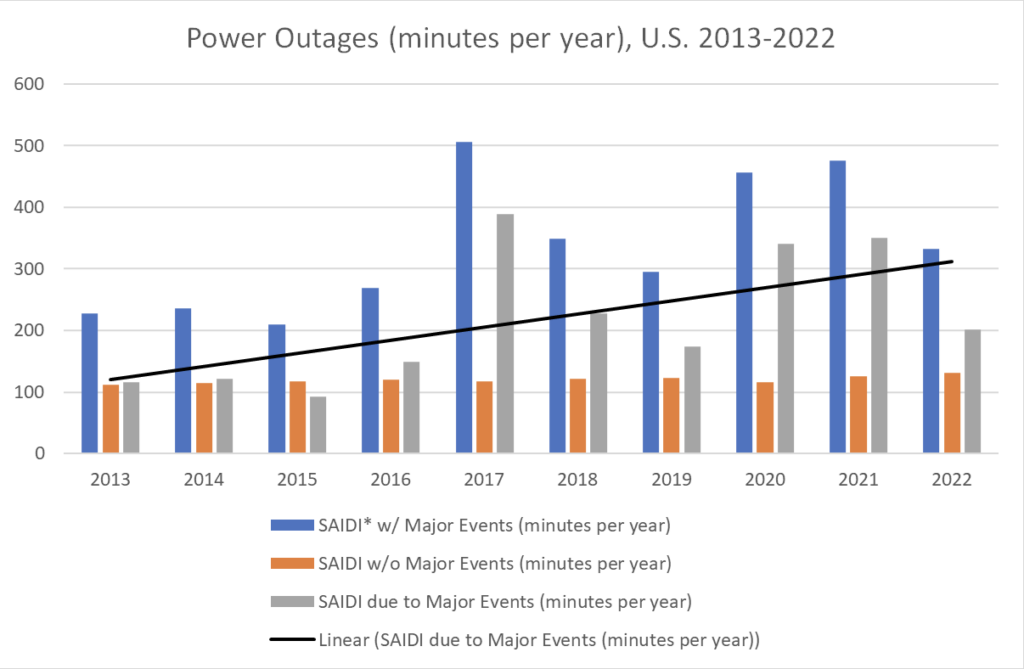

Increasingly extreme weather events are already challenging the grid’s ability to meet present and future electricity needs. A large portion of the grid was built in the 1960s and 1970s and is coming due for replacement. Wildfires, snowstorms, and hurricanes of record-setting severity are placing this aging equipment under increased strain. The effects are becoming clear: in 2022, U.S. customers experienced an average of 86.6 more minutes of outages due to major events such as natural disasters compared to 2013.

Data Source: EIA

*System Average Interruption Duration Index

Sometimes, the issue has to do with extreme-weather-related shifts in demand. For example, California was forced to implement statewide rolling blackouts in August 2020. In a report examining the causes of these blackouts, the California Independent System Operator (CAISO) found that the extreme heatwave hitting the Western U.S. at the time contributed to higher-than-expected electricity demand, so much so that even CAISO’s reserves were insufficient to cover the shortfall.

In other cases, severe weather has impacted grid infrastructure itself. Hurricane Beryl, the earliest Category Five hurricane in the history of the Atlantic hurricane season, severely damaged transmission lines and obstructed power to around two million people in the Houston area when it reached Texas as a Category One hurricane in July 2024. Although CenterPoint Energy, the utility company that serves most of the area, had coordinated with workers outside of Houston before Beryl made landfall, the company claims that a deviation from the storm’s predicted path left them unprepared for the scale of the outages.

Innovation and Technology

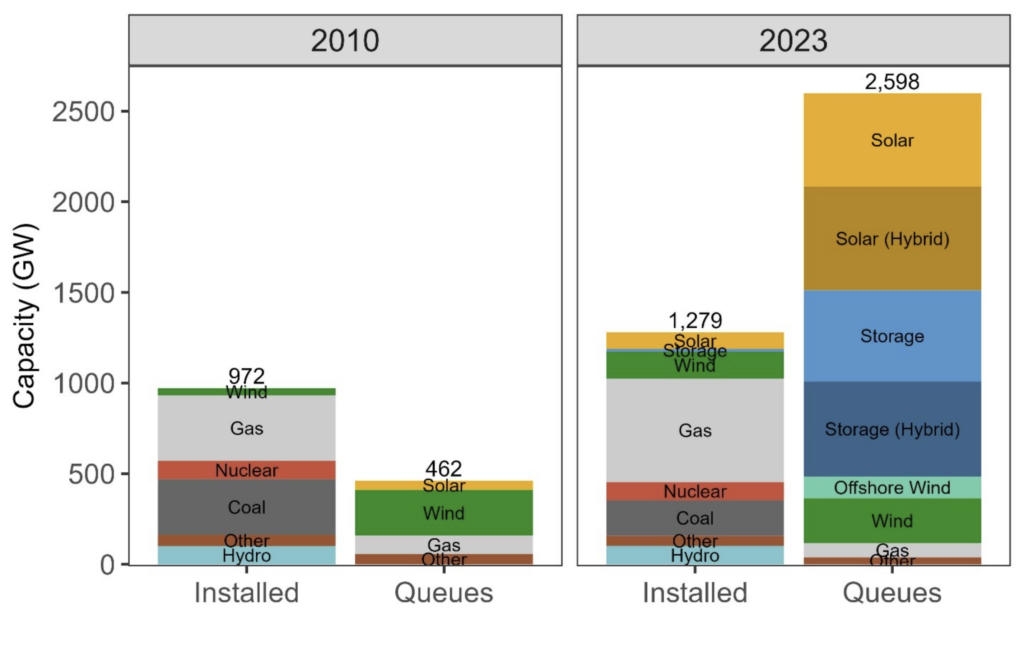

Amidst these challenges, economic and technological developments are opening up new possibilities for the grid. One prominent example is the falling cost of wind and solar energy. Decades of research, investment, and adoption have made these technologies cost-competitive with natural gas on the utility level. These energy sources could play a key role in meeting the predicted surge in U.S. energy demand.

Connecting wind and solar farms to the grid, however, requires more high-voltage transmission lines than for fossil fuel power plants, as the electricity they generate usually must be transported longer distances. Currently, a lack of sufficient transmission infrastructure means project developers are charged large fees for interconnection. These fees are a major roadblock for the almost 1,500 GW of planned wind and solar projects in the interconnection queue.

Innovations are not limited to the generation side of electricity. Researchers have developed superconducting transmission lines that can transport up to 10 times more power than a traditional line. Digital technologies are facilitating the creation of the “smart grid,” which can more effectively redirect electricity when grid conditions or demand change. Microgrids, which can distribute power locally when other parts of the grid are disrupted, have also garnered increased interest. Given the economic costs of power outages in foregone productive activity, the potential savings from adopting these technologies are significant.

Policy Issue: Right of First Refusal Laws

These new developments necessitate policies to incentivize transmission construction and the adoption of promising new technologies. Right of first refusal (ROFR) laws are particularly relevant to this issue. These laws grant exclusive rights to incumbent utilities to construct transmission lines in their service territories unless they decline to do so. ROFR laws have so far been adopted by 12 states, although the Texan ROFR law was recently declared unconstitutional by the Fifth Circuit Court of Appeals.

Critics allege that these laws are anticompetitive, entrenching utility monopolies and hindering the regional coordination processes needed to build large transmission projects and connect renewable energy to the grid. In 2011, FERC attempted to address this issue through Order No. 1000, which removed the federal ROFR for certain transmission projects and opened them up to competitive solicitation. Under this process, multiple companies could submit proposals to the relevant ISO or RTO, and one of them would be selected to build the project. Proponents of solicitation cite a 2019 report claiming potential average cost savings of 25 percent on competitive projects and increased innovation as benefits of solicitation.

ROFR advocates counter that these cost savings are a mirage, pointing out that most projects solicited under Order No. 1000 have gone over budget and behind schedule. More recent analyses of the projects in the 2019 report show that they exceeded baseline cost estimates by 12 to 19 percent on average. Although many competitive proposals contain initial cost caps, they often exceed them due to exemptions in the caps for events such as regulatory delays. In practice, such “delays, re-routing, and other environmental challenges” have been a major cause of cost overruns for transmission projects developed by non-incumbents. Incumbent utilities, so the theory goes, could more effectively avoid these pitfalls.

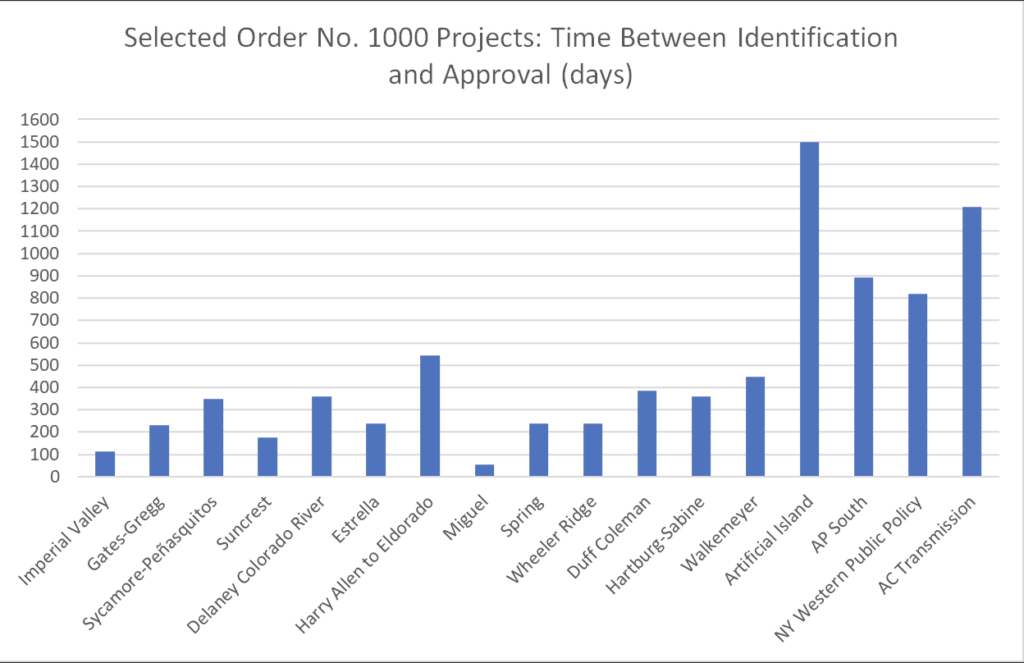

The current regulatory process for building transmission lines is indeed complex. Entities constructing these projects must gain regulatory approvals from federal and state agencies as well as state eminent domain for local landowners, if the transmission line passes through private lands. As of now, the data seem to indicate that incumbent utilities can better navigate this process than other transmission companies. Proponents of ROFR also point out that solicitations themselves expend time and resources. For 15 competitively solicited projects under Order No. 1000 analyzed in 2019, the process took anywhere from 113 to 1,498 days, save for Miguel Substation, which only received a single bid from the incumbent utility.

Source: Concentric Energy Advisors, Building New Transmission: Experience to-date Does Not Support Expanding Solicitations, June 2019

Of course, the sample size of projects examined here is relatively small. It is possible that, having sunk the cost of establishing local relationships and regulatory expertise, non-incumbent transmission providers may eventually achieve project costs and development timelines comparable to incumbent utilities. Reaching this point, however, will take time. Combined with the delays of solicitation, waiting for non-incumbent providers to overcome entry barriers could prevent needed transmission from developing quickly enough.

These barriers could theoretically be lowered by simplifying the regulatory structure for transmission line approval. Indeed, the proposed SITE Act in Congress would do so by granting FERC sole authority to permit interstate, high-voltage transmission projects. Whether or not such a solution is necessary, however, requires more in-depth analysis. It is worth noting that transmission owners can likely add substantial transmission capacity simply by upgrading their existing infrastructure rather than having to construct new lines.

A final point to consider is the role of innovation. Economic logic holds that firms are more likely to innovate if they can escape competition by doing so. Constructing more long-distance, high-voltage transmission lines could facilitate greater competition between utilities by further opening up markets beyond their local service territories. As a result, they might invest more in resilience and new technologies. It remains to be seen if this kind of innovation can still occur under ROFR protections. As it is, insufficient data exist to definitively conclude that ROFR laws help or hinder innovation and efficiency in regional grid infrastructure.

Conclusion

Electricity remains crucial to the U.S. economy and will likely become more so in the years to come. The importance of the grid will grow accordingly. Behind new solar farms, semiconductor fabs, and AI applications are the power lines and substations linking all of them together. In the face of new threats to the grid, sound policy to facilitate adoption of promising technologies, siting and construction of new transmission lines, and upgrades to existing infrastructure will become indispensable. Now over 100 years old, the electrical grid is key to bringing the U.S. economy into the future.